We use reader data to auto-curate the articles, meaning that the most valuable resources move to the top. Our Income Protection Insurance can be used to protect your monthly rent and living expenses if you cant work because of a long term illness or accident Each of following insurers who transact business in California are domiciled in California and have their principal place of business in Los Angeles, CA: Farmers Insurance Exchange (R 201.

Contractor expenses toward income professional#

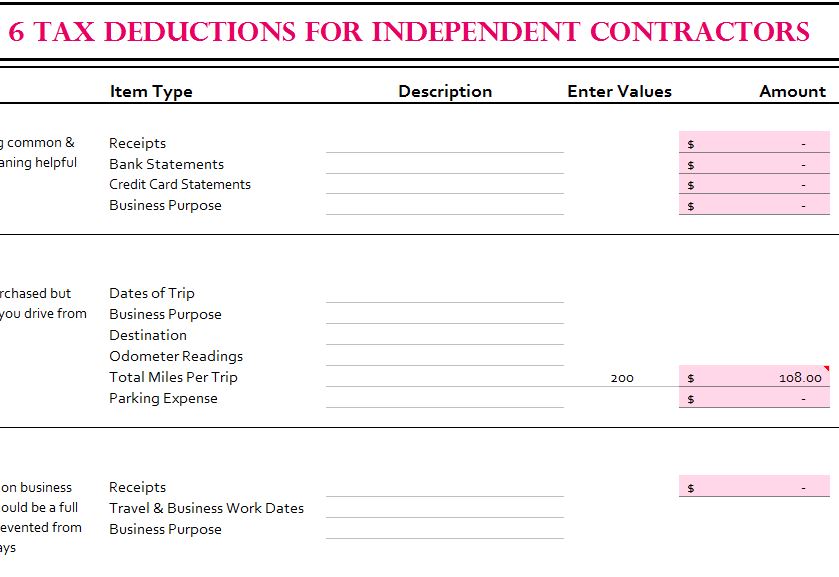

Professional Constructor Central is a collection of the leading industry thought leadership in the form of blogs, webinars, and downloadable resources, on one convenient website. 2020 Professional Constructor Central MVP Awards.Taxes on gasoline, diesel fuel, and other motor. Some construction contractors, although currently unable to produce a profit, still have a substantial exposure in the form of continuing expenses if a suspension of business occurs. The Payroll Tax Act 2011 applies payroll tax to contractors. You can deduct as a business expense excise taxes that are ordinary and necessary expenses of carrying on your trade or business. Some claimable expenses include business insurances, computers and laptops, work stationery, telephone bills and training. Many Australian businesses hire contractors or subcontractors rather than permanent employees. Saskatchewan homeowners may save up to 2100 in provincial income tax by claiming a 10.5 tax credit on up to 20000 of eligible home renovation expenses. An excise tax isn't deductible if it's for a personal expense. That way, you will not be paying tax on the reimbursement because it will be subtracted from. Then, you will include the amounts that were reimbursed to you as an expense.

Contractor expenses toward income full#

0 kommentar(er)

0 kommentar(er)